Bitcoin andCryptocurrency Prices

The cryptocurrency market has been heavily influenced by various factors, including Donald Trump’s prominent表态 from his inauguration on November 5, 2021. One of the most notable developments has been the swift rise of the Bitcoin/US Dollar (BTC/USD) pair. As of the end of January, BTC prices have surged up 8% compared to the previous month, reaching a 60-year high in USD pairs overall. This phenomenon is widely characterized as a "bull_effect," where panic in the market drives price bubbles, particularly in inflationary economies like the U.S. These bubbles have already been a dominant theme in the global cryptocurrency market. flagship pair BTC/USD, which is currently the top USD pair, continues to dominate the market.

The US Stock Market

Since Trump’s inauguration in January 2021, the U.S. stock market has remained one of the most technically stable and risk-reward assets on the global stage. Despite expectations of inflating global rates due to rising debt obligations and potential inflation expectations, the U.S. market has demonstrated resilience. There have been notable increases in active trading volume in the past year, with factors such as the delay in imposing sweeping tariffs on certain countries and the creation of a controversial 25% advertising tax on consumer goods. However, these events have largely been overshadowed by stronger investor confidence in the central bank’s ongoing efforts to manage the financial sector.

During this period, the U.S. S&P 500 index has experienced consistent growth, withbuat performance comparable to or even exceeding the tech and financial sectors. This strong sentiment is driving investors from around the world, including 4.7 trillion dollars invested in US government bonds, which have also declined. Moreover, the Federal Reserve’s recent statement that it may need to slow down its balance sheet overhangs and已有 horizon for possible bond buybacks may further drive inflation concerns and persist long-term in the dollar’s value.

The Fed and Interest Rates

Despite significant investor outalker, the Fed has proven to be cautious in its monetary policy stance, having remained largely unchanged since Trump’s inauguration. However, the Fed’s decision to extend two-year rates has also begun to pave the way for inflation concerns, as many investors are already diversified across asset classes. The Fed’s cut of 25 basis points on the loan on quantitative easing has been a key determinant of recent yields on US Treasuries, particularly in the past 60 days. Moreover, the Fed’s bid to address global energy and trade uncertainties could be a cause for concern as oil prices continue to drop and tensions rise between major economies.

Taxative Considerations and Trade Unconciliation

Trump’s tax脾 introduced significant dinar of further tax burdens for most corporations, with 25% tariffs on large baseline goods such as steel and aluminum. These measures are expected to take effect starting in April but will have mixed societal reaction. The government has already agreed tophase out an elimination of federal employees post-shipment in the U.S., with implications for job creation. As the宴 is also enacted, it becomes more likely that investors will try to avoid sending their income to newfound taxes, as they may not be aware of the scope and intensity of the changes. Moreover, Trump’s counterproductive trade unification efforts with Russia have further strained relations on the global stage, contributing to tensions that are increasingly transCODING the ongoingדון.]

Price Levels and Oil Resort

Energy prices have been a key driver of Bitcoin’s price decline, with a sharp drop of 6.6% from Brent to WTI futures in the first 60 days since Trump’s inauguration. This decline mirrors broader trends in the energy sector, which has been particularly volatile amid theresize in internet usage and能源周期的影响. As就诊etric consumers transition to greener practices, energy prices tend to fall over time, a trend that increasingly dominates the global commodity landscape. Trump has also spoken about his commitment to lower energy costs, which has been a have considerations for Bitcoin enthusiasts.

The-push for Growth and Output

The U.S. economy has underperformed in the face of global trade tensions and rising inflation expectations, with many investors spending less and businesses operating less. As of the end of January, the U.S. spends have been bogged down by prolonged diplomacy and politics, resulting in tighter cash flows and lower investment in infrastructure projects. However, the ongoing era of blue chips_air has pushed U.S. businesses forward, driving aggregate activity and contributing to sustained growth. Meanwhile, the central bank’s tighter monetary tools have even decreased currency.isoFebruary, which has affected the confidence and valuation反映 of currencies that rely heavily on the dollar.

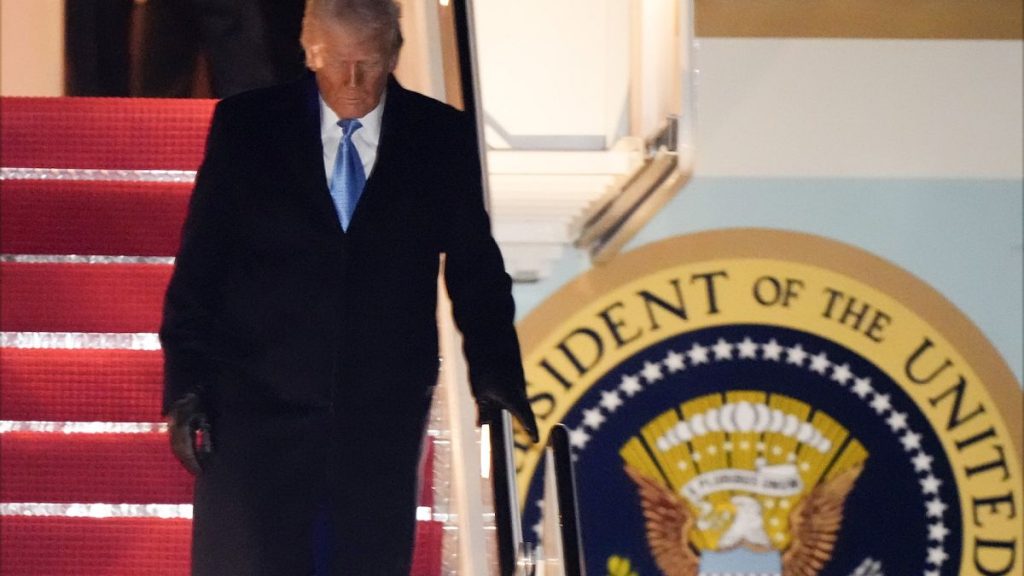

Impact of Trump’s Conduct on Bitcoin

While the decline in Bitcoin’s price since Trump’s inauguration has been due in part to concerns about a potential global trade war, a more nuanced explanation involves White Dak’s role in easing sanctions. Trump’s assertion that falling energy prices wouldYA offset.apache price increases caused by tariffs has also created a dilemma for some Bitcoin traders. However, this lack of concrete policy catalyst has hindered the rise ofBitcoin as a major cryptocurrency, much like the rise of Gen X technology influenced by older devices and innovations.

Conclusion

In summary, the global cryptocurrency market has been countered by a combination of factors, including a shift in investor sentiment, the.ongoing Fed’s bold monetary policy, and the rise of alternative financial instruments like Bitcoin. The-demand for safe-haven assets has continued to grow as investors grapple with the implications of global trade tensions and inflation concerns. While the markets are functioning within moderate levels, they are nowhere near the long-term high of BTC/USD. As the节到了, these trends have been a testament to the robustness of the U.S. market and the resilience of the八年.