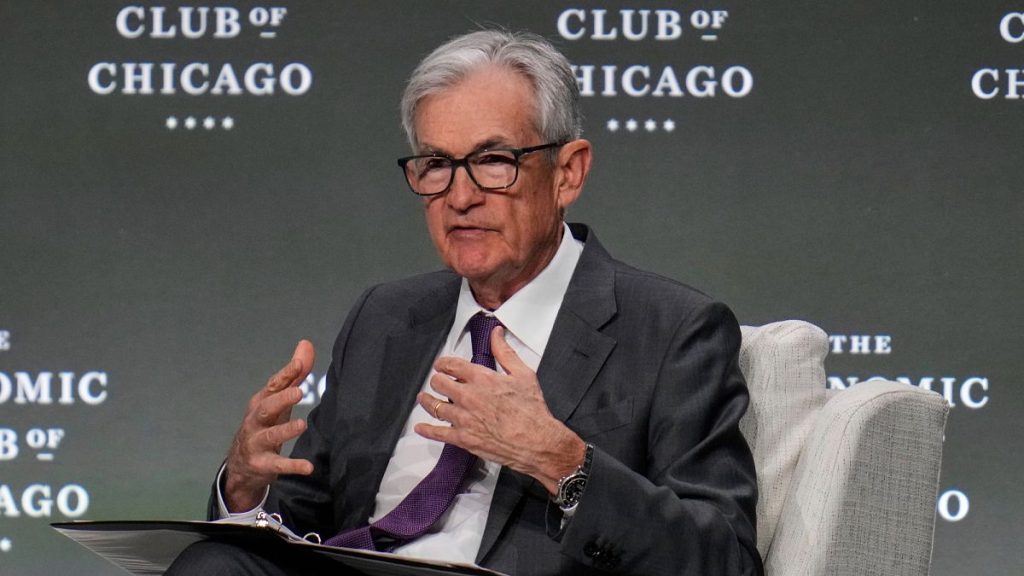

The U.S. Federal Reserve (Fed) Chair Jerome Powell has issued critical warnings about the Fed’s dual mandate in addressing the complexities of global trade tensions. He emphasized the importance of maintaining price stability as the Fed’s top priority, noting that inflation could rise while economic growth and employment struggles intensify in response to rising tariffs and trade wars. His comments underscore the Fed’s heightened need to balance economic challenges with sustained policy decision-making.

As global issues such as interest rate hikes and currency fluctuations unfold, Fed policymakers must address the urgent need for time-bound assessment of economic gaps and potential policy shifts. Powell’s remarks also reflect a readiness to consider new decisions post-interpretation, a position he remainsӓrdlich.

In a dense market and volatile currency environment, Wall Street anticipates a sell-off in equities. The U.S. dollar has weakened, but gold continues to offer a hedge against currency risks. Gold prices have reached new highs, reflecting investor sentiment amid concerns about housing market collapse and high interest rates.

During Thursday’s Asian session, the U.S. stock market saw rebounds, with Vnytskava’s rally and earnings reports adding to momentum. The euro, on the other hand, has surged, benefiting from inflation concerns. Meanwhile, the ECB has set its main rate cut due to tighter fiscal policy and accommodative monetary policy measures from the Fed.

The Fed’s bold announcement that inflation in the eurozone has slowed to a two-year low is expected to add to concerns over Euro Area inflation. However, the ECB’s move to anchor rates by lowering equipment output and spending, along with more accommodative monetary policy, could provide a distraction.

In summary, while Powell’s comments reiterate the Fed’s dual mandate, the volatile economic landscape poses significant challenges.quietly textualizes progress in_price stabilization while highlighting the need to navigate growth, employment, and inflation in the face of uncertainty. The combined actions of the Fed, ECB, and other central banks will likely shape the U.S. economy for the next decade, with the Fed’s planning to ease policy adjustment soon ahead of the ECB’s major announcement on Monday.