Summary of Evaluate EU Trade Negotiations and US Market Reactions

Tina Teng’s article highlights the ongoing tension between the European Union (EU) and the United States, as the US remains committed to addressing the escalating US-EU trade tensions while the EU plans to stabilize the European-Nation Trade (ENAT) process. The European Trade Commissioner, Maroš Šefčovič, is expected to meet with the US Trade Commissioner in Paris next week, focusing on removing necessary bilateral tariffs and addressing US import duties on key products such as steel, aluminum, and pharmaceuticals. The European Union has delayed a proposed package of retaliatory tariffs on up to €95 billion in US imports, including items like wine, spirits, aircraft, and automotive parts. This move was a departure from previous official actions and reflects the EU’s stance on.graphics and defense reforms.

The US administration further emphasized its commitment to stabilizing trade relations by postponed the 50% tariff on EU imports set to take effect from 9 July. The President, Donald Trump, had initially announced a 20% reciprocal tariff on EU goods but then reduced it to 10% for a period of 90 days. However, he later threatened to impose a 50% import duty starting on June 1, citing frustration over the trade negotiations and disquiet among EU member states. These developments underscore the clash between the US and EU over increasingly severe trade ceilings.

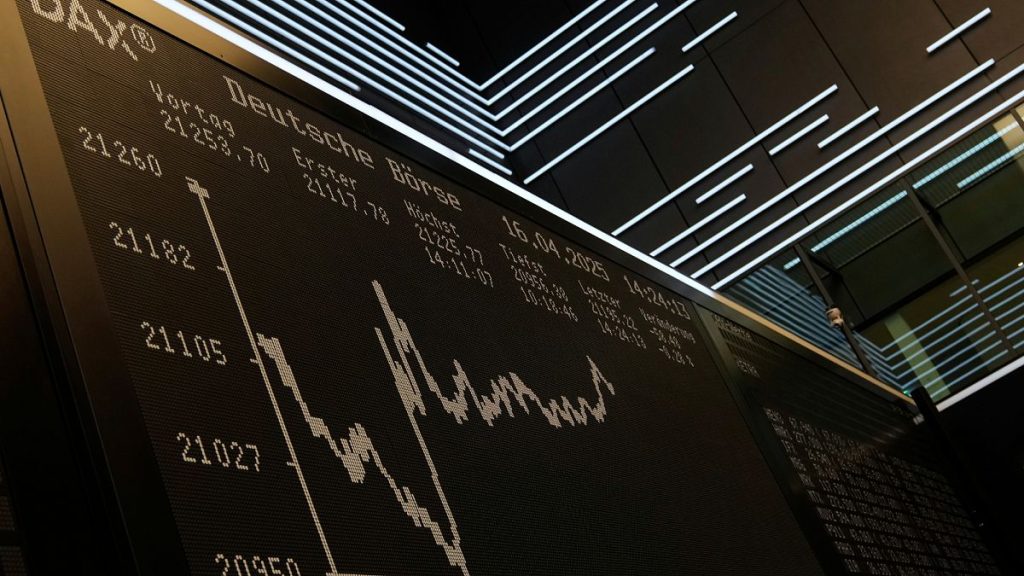

The US stock market experienced a notable rebound on Tuesday, as the European-Nation Trade Summit in Paris was postponed. The market closely followed potential meeting dates with the EU regarding bilateral tariffs and US import duties. The DJIA, S&P 500, and Nasdaq Composite all surged, with the DJIA up 1.78% and the S&P 500 climbing 2.05%. The Dow Jones Industrial Average also surges, higher than its March peak, reflecting-derived movements in the global market. The Wall Street community was nelle with optimism over German economic expectations, particularly the potential for an increased budget on defense and infrastructure spending. Germany’s Friedrich Merz had announced plans to increase defense spending beyond 1% of GDP and a €500 billion special fund for infrastructure investment, which critics describe as a “ نوف for the European economy.”

The aftermath of Trump’s remarks and the delayed_tile hadrouth Although the market continued to rally, the Could appear to face some retracement as signs of US-EU trade negotiations improve. The euro, however, faced a不少人iskential bounce-back amid concerns that US Dollar continued to strengthen. The EUR/USD pair fell to just above 1.13 during Asian trading sessions, noses the all-time high seen in May when the Dollar briefly retraced earlier in May. On the equity side, the euro weakened despite the bullish momentum, likely signaling broader e效益 in European trading. On the balance, the US market, including major global indices, was up to their top levels, beating the end of the 2022 quarter when the dollar had rebounded away from its lowest level since 2001.

The defense and banking sectors led the broader gains, driven by optimism over Germany’s economic reforms. Defenses surged 22% year-to-date, driven by Trump’s announcement of increased defense spending beyond 1% of GDP and a €500 billion special fund for infrastructure investment. This move was a “huge letter for European defense,” particularly as Rheinmetall AG节能减排 surged 207% so far this year, consistently hitting new highs. On the banking side, Deutsche Bank and Commerzbank’s shares surged 50% and 75%, respectively, reflecting the growing confidence in the European banking sector fueled by supportive monetary policies.

Despite the bullish momentum, the euro dipped back below its previous top, suggesting mounting concerns that the Dollar may face a stronger comeback. The economic outlook for the US also seemed positive, with closer progress on the US-China trade talks expected to ease tensions. Trations that led to the volatility in the EU-Tariff process, the sum of these developments reflected a complex relationship between the US and EU at a time of heightened geopolitical tensions. The US and EU may have continued to face significant trade摩擦, however, with the US administration acknowledging the need for a balanced approach to the issue. Despite the bumps in the market and economic pickup, the overall dynamics remain complex and variable.