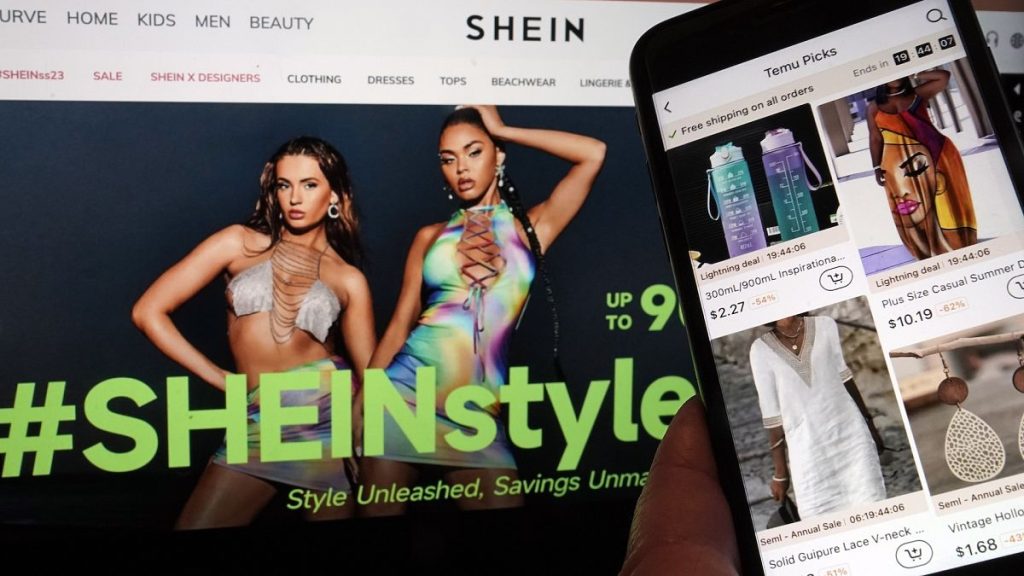

The UK’s parliamentary business and trade committee convened a hearing with senior managers from fast-fashion giants Shein and Temu to address growing concerns about their labor practices and supply chain transparency. The hearing took on heightened significance given reports that Shein, originally founded in China but now headquartered in Singapore, is aiming for a substantial £50 billion listing on the London Stock Exchange. Both companies have gained immense popularity by offering a vast array of affordably priced goods, primarily sourced from China. However, this meteoric rise has been shadowed by allegations of forced labor within their supply chains, particularly concerning the Xinjiang region of China, where human rights abuses against Uyghur Muslims and other minority groups are widely documented.

During the parliamentary hearing, Shein’s general counsel, Yinan Zhu, repeatedly declined to answer questions about the presence of Xinjiang cotton in their products. Zhu also refused to confirm whether the company’s code of conduct prohibits suppliers from using Xinjiang cotton or to comment on the potential for forced labor within the region. Instead, she insisted that Shein complies with all relevant laws and regulations in the countries where it operates and emphasized the thousands of audits conducted by external firms to ensure the integrity of its supply chains. This evasiveness drew sharp criticism from committee members, who expressed “horror” at the lack of transparency and questioned the company’s commitment to ethical sourcing.

The committee chairman, Liam Byrne, characterized Zhu’s responses as bordering on contempt and stated that her testimony provided “zero confidence” in the integrity of Shein’s supply chains. The company’s previous attempt to list on a US stock exchange was thwarted by American politicians demanding assurances that Shein does not utilize forced labor from Xinjiang. The current push for a London listing has ignited similar concerns among UK politicians and human rights advocates. Shein’s rapid growth, marked by a doubling of UK profits and a significant increase in sales in 2023, underscores the scale of the potential ethical and governance challenges posed by its business model.

In contrast to Shein’s reticence, Temu’s legal representative, Stephen Heary, acknowledged the seriousness of forced labor concerns and stated that the company prohibits sellers from the Xinjiang region from using its platform. However, a 2023 US Congressional report raised serious doubts about Temu’s supply chain oversight, citing an “extremely high risk” of forced labor involvement and criticizing the company’s lack of audits and compliance systems. This discrepancy between Temu’s stated policy and independent reports highlights the difficulty in verifying claims of ethical sourcing within complex global supply chains.

The parliamentary hearing exposed the challenges faced by regulators in holding fast-fashion companies accountable for their labor practices, particularly when their supply chains extend into regions with documented human rights abuses. The contrasting approaches taken by Shein and Temu, with the former opting for evasion and the latter offering limited transparency, reflect the spectrum of responses within the industry. The scrutiny faced by both companies underscores the growing awareness and concern among consumers and policymakers regarding the ethical implications of fast fashion’s pursuit of low prices.

The case of Shein and Temu highlights the broader issue of ensuring ethical sourcing in the globalized fashion industry. The reliance on complex and often opaque supply chains makes it difficult to monitor labor conditions and ensure compliance with ethical standards. The pressure on companies to maintain low prices and rapid production cycles can incentivize cost-cutting measures that may compromise worker rights. The increasing scrutiny from consumers, policymakers, and human rights organizations is driving a demand for greater transparency and accountability within the fashion industry. However, effectively addressing these challenges requires a multi-faceted approach involving stronger regulations, robust monitoring mechanisms, and greater corporate responsibility.