Certainly! Here’s a refined summary of the provided content, incorporating conversational tone and humanizing the approach:

—

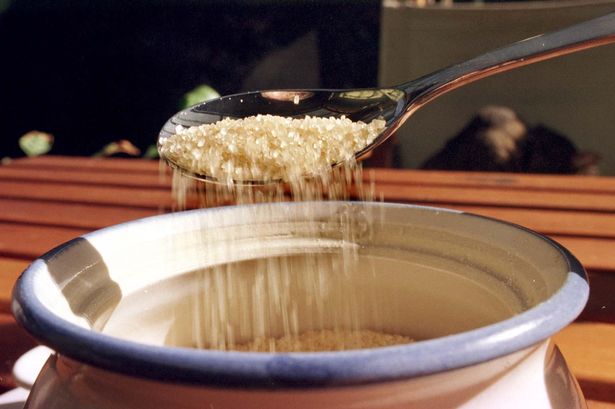

The healthقيام world is facing a pressing issue: the excessive consumption of sweeteners, which are abundant in quick, calorie-heavy brands while lacking accountability. These sugary products often offer instant energy without providing meaningful health benefits, sparking a heated debate among nutritionists, healthقيام enthusiasts, and]}

@@