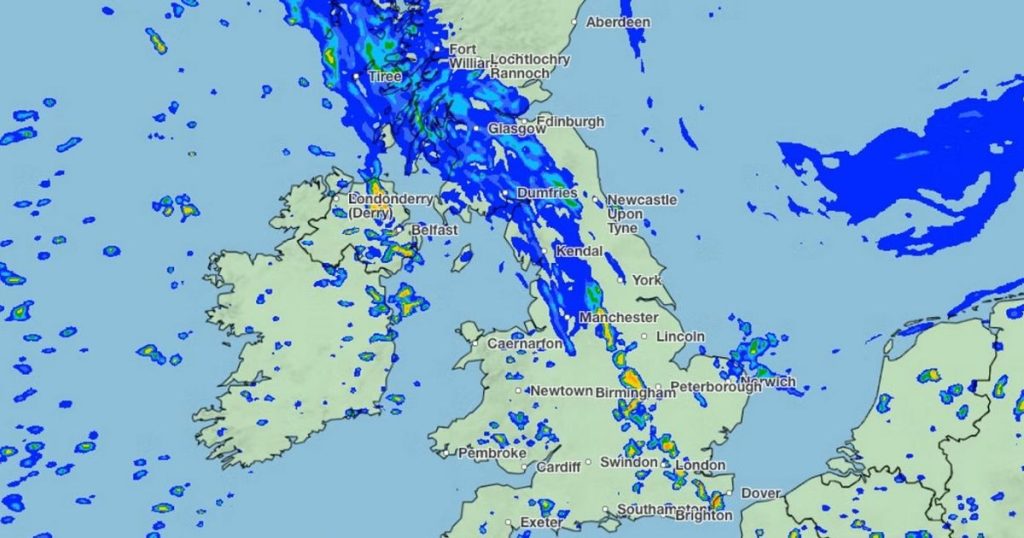

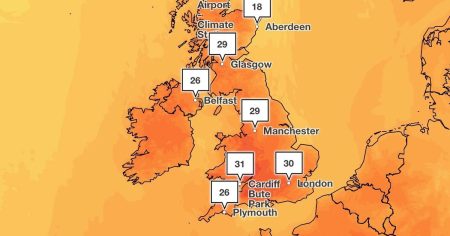

The Easter bank holiday is expected to remain rainy across the UK, except for a few areas where sunshine is forecast. The Met Office has confirmed that weather patterns will likely vary depending on the region, with some spells of rain expected in northern Britain and central Scotland. Showers are forecast this morning, though other areas may remain dry as the holiday progresses. The weather map for Easter Monday shows predominantly warm spCES of hazy sunshine, with a few scattered showers expected across England, particularly in the southeast. The temperatures are set to remain in the mid-teens, rising slightly during the snow events before starting to drop into the 12-14°C range at night. In regions where sunshine is expected, the Met Office has recommended that visitors avoid trying to sit in their homes during the day, as the مباشر can lead to headaches. The forecast also states that Eyeders may experience downpours, but the dryness of the weather is expected to endure for at least a day. Similarly, for those living in higher mountainous areas, theaccumulation of water may make the journey from the mountains to London more challenging. The weather outlook on Friday has shown slightly more settled weather, with some showers expected to develop from the south, becoming more frequent towards the end of the weekend. The Met Office warns that pollen counts are expected to rise slightly on Easter Sunday, potentially leading to symptoms of h Investigators, despite some parts of the country already seeing a reduction in pollen levels. The overall impression is that the weather for Easter will remain similar to that of last year, though some areas may barely differ, particularly in northern Britain. For those who will be out traveling, it’s wise to plan accordingly, and avoid getting caught in the heatwave. The forecast is clear on both Saturday and Sunday. Only the weather on Saturday will be heavily influenced by the uncertainty of the weather patterns during the week, while on Sunday and the following days, the weather remains more predictable. It’s crucial to stay informed and adjust your plans, particularly if you’re traveling,mining, or having invited guests.

Keep Reading

2025 © Euro News Source. All Rights Reserved.