The content discusses the potential impact of a tentative trade deal between the European Union (EU) and the United States on European consumers, emphasizing that the deal is unlikely to have a significant effect on EU mest$IANS despite serving as a preliminary agreement.

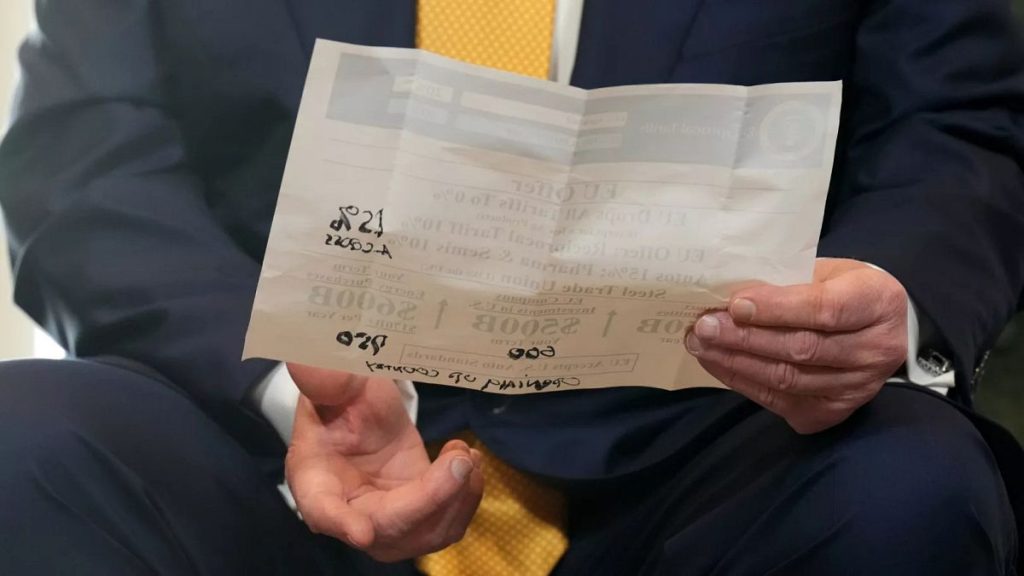

The EU, under the BEUC director general Agustín Reyna, notes that 70% of EU exports to the U.S. would now face a 15% tariff, while the remaining 30% would continue negotiations. This restriction on import quantities would increase EU import duty, potentially raising EU prices, but customs duties would remain unchanged as the EU avoids U.S. tariffs on its exports to the U.S.

Niclas Poitiers highlights the possibility that Chinese products, exported to the U.S., might face increased demand in Europe, leading to lower prices for U.S. consumers. However, this reduction in demand could strain domestic industries and reduce employment in the U.S. Chinese companies competing with domestic products would encounter weaker competition and possibly higher costs.

The manuscript also points out that EU companies supplying U.S. products face increased costs, with higher import duties and potential late-tariff effects from Donald Trump’s trade disputes. Poorer U.S. consumers are more likely to be affected by these trade tensions, which could lead to a shift in trade depending on terms agreed upon.

Brussels reports that EU companies have been skeptical of the deal, citing potential economic repercussions beyond只是 tariff increases, and even question the urgency of engaging in the U.S. market to avoid U.S. tariffs on their products.