Intel’s recent announcement regarding the retirement of CEO Pat Gelsinger after less than four years highlights the prevailing turmoil within the semiconductor giant. The news came as a shock to both industry analysts and employees, given Gelsinger’s pivotal role in the company since he rejoined as CEO in early 2021. He took over during a tumultuous period when Intel was grappling with declining market share and increasing competition from rivals such as Nvidia, which has become the dominant player in the AI chip market. As Gelsinger steps down, David Zinsner and Michelle Johnston Holthaus will serve as interim co-CEOs while the company embarks on a search for a new leader. These leadership changes come not only during a critical time for the company but also reflect broader challenges that Intel continues to face in the fast-evolving semiconductor landscape.

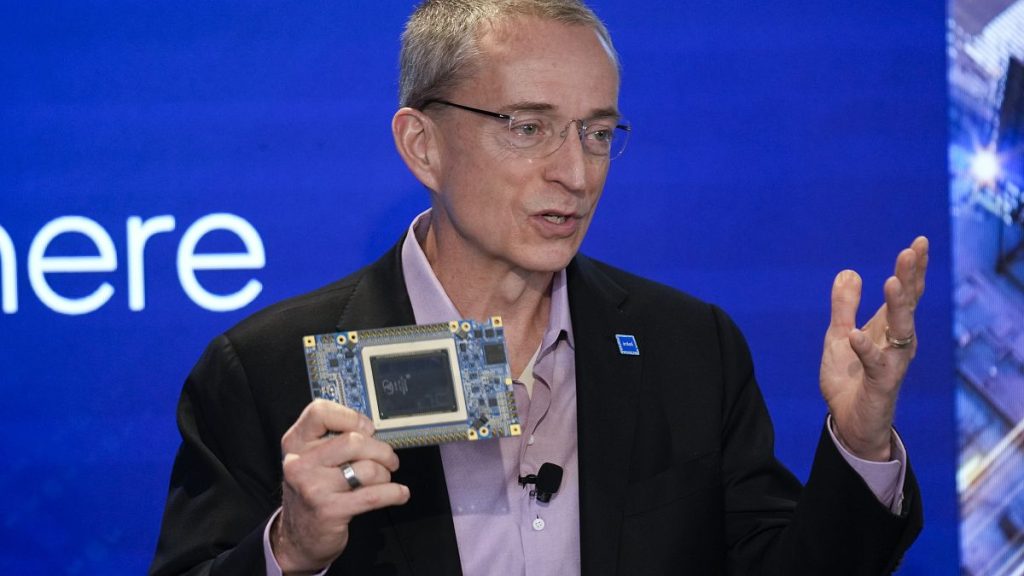

Under Gelsinger’s leadership, Intel aimed to revitalize its manufacturing capabilities and reclaim its status in the semiconductor industry, which it once dominated. His tenure was marked by significant investments in state-of-the-art manufacturing technologies and efforts to innovate across the company’s diverse product lines. Gelsinger’s earlier experience as Intel’s first chief technology officer provided him with a unique perspective to drive transformation within the company. However, despite ambitions for a turnaround, Intel’s financial performance has taken a downturn, as evidenced by the staggering $16.6 billion loss reported in the most recent quarter. This bleak financial statement underscores the pressing challenges that persist at Intel, especially as the company attempts to pivot amidst increasing competition and broader economic conditions.

In response to its financial struggles, Gelsinger implemented a cost-cutting strategy that included plans to reduce the workforce by 15 percent, amounting to approximately 15,000 job cuts. While this decision was made to save around $10 billion by 2025, it has raised concerns about the company’s future stability and morale among remaining employees. The announcement of layoffs comes amidst broader industry challenges, such as supply chain issues and rising material costs, which have also contributed to Intel’s financial pressures. As the company confronts these hurdles, interim CEOs Zinsner and Holthaus will have significant responsibilities in navigating both the operational realities of the company and the expectations of stakeholders amid ongoing turmoil.

Separately, Intel’s financial schedule might also be affected by recent decisions made by the Biden administration regarding federal funding for semiconductor manufacturing. Discussions emerged about potentially reducing Intel’s planned federal support of $8.5 billion intended for the company’s chip manufacturing initiatives. This reconsideration seems tied to the broader funding framework created as part of an agreement to supply computer chips for military uses. While the adjustment in funding is not directly linked to the company’s financial performance, it highlights the vulnerability of Intel’s situation within the national conversation on semiconductor production and U.S. technology policy. Given the geopolitical implications and competitive landscape, these funding shifts present additional challenges for Intel as it strives to secure its place in the global semiconductor industry.

The company’s recent struggles also became evident when Intel was replaced by Nvidia on the Dow Jones Industrial Average, highlighting the seismic shifts occurring within the semiconductor sector. Nvidia’s ascent, especially in the AI domain, has not only overshadowed Intel but has also set new expectations for technological advancement and market performance. This transformation emphasizes the imperative for Intel to realign its strategic focus to better compete in this evolving landscape. Analysts believe that finding a new CEO who can galvanize Intel’s workforce, integrate advanced technologies, and rekindle investor confidence will be pivotal in any future recovery initiative.

Finally, despite the troubling financial results and executive changes, Intel’s stock price showed a modest increase immediately following the announcement of Gelsinger’s departure, suggesting potential optimism amongst investors regarding new leadership. However, it’s important to note that Intel’s stock has plummeted by 42 percent over the past year, pointing to deep-rooted concerns about its long-term viability. As the company embarks on this new chapter under interim leaders, it faces the monumental task of reclaiming its heritage as a semiconductor powerhouse while navigating the relentless pressures from competitors and shifting market dynamics. The road ahead will be characterized by critical decisions, both strategically and operationally, as Intel seeks to redefine its future in an increasingly competitive marketplace.