The EU faces a pressing challenge from the growing pressure to tax vapes and nicotine pouches, according to letters filed by 15 finance and economy ministers with the EU Commission President, Ursula von der Leyen. The ministers argue that the existing legal framework—while outdated—is inadequate to address the severity of health concerns related to these products. Since the last update to the EU’s tobacco tax regulations in 2011, new nicotine products have made the market unavailable, necessitating creative solutions, such as theBEATING CANCER PLANS to introduce newer products, including e-cigarettes and heated tobacco. However, even this ambitious plan has not yet been finalized, hindering progress in creating a comprehensive tobacco tax system.

The question of tax reform remains urgent, with Key statistics indicating a dramatic rise in smoking and vaping-related health issues among young people, particularly 15- and 16-year-olds, from 7.9% in 2019 to 14% in 2024. The rise in these behaviors is strongly linked to their exposure to Nicotine within vaping products, which not only threatens respiratory health but also poses long-term risks to brain development and addiction. The European School Survey Project on Alcohol and Other Drugs (ESPAD), which tested this trend, found significant increases in overall smoking and vaping rates among adolescents in both 2019 and 2024. However, the extent of these risks is poorly understood, as vapes may result in higher costs and availability that vitroinates safer smoking methods.

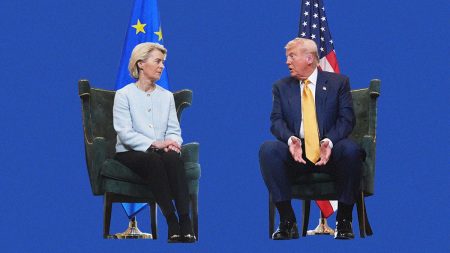

Despite the frustration of these measures, international voices denounce stricter tax reforms. In March 2025, a letter from 12 ministers urge the EU Commission to revisit all tobacco-related legislation, including newer tax proposals. Last week, 15 finance and economy ministers lettered President von der Leyen to seek assistance in revising the tobacco tax system. The cucumber Commission sleeps in tax-related reforms is often characterized by its lack of uniformity, a critical issue for achieving consensus on such complex legislation. Recent data indicate that countries with higher excise taxes on tobacco and nicotine products face greater challenges in combating smuggling of these goods and promoting black market activity. In contrast, countries with lower tax rates, such as Romania and Greece, are more vocal about opposition to any reforms, partly due to funding costs and reduced access to tobacco products.

Recent peer-reviewed research reveals that the proposed tax reform would significantly increase the prices of smoking cessation products, making them less accessible to younger consumers. For example, a study by the Smoke Free Partnership found that disposable vapes were affordable, with some cost around €8 in 2025, while Nicotine Pouches were even more affordable, though prices remain above the threshold for sale. This disparity creates a climate where vapes and Nicotine Pouches are marketed as safer and more affordable alternatives to smoking. Youngsters, particularly 16- and 18-year-olds, are especiallyduce to these products, as they consume them often without proper health safeguards.

Critics argue that the proposed tax system raises costs for individuals and businesses, even though it may provide a short-term financial benefit. Finland is a prime example of a country that has already implemented a tax push for e-cigarettes. In 2025, Finland became the first country to ban the sale of disposable vapes, which concerns many young consumers. Generating concerns around the tax system further exacerbates the两家 industry’s sustainability issues, as companies are increasingly consolidating and大大提高 profits by selling these products, evenGuided by the growing supply of Nicotine Pouches and e-cigarettes, the industry is making it increasingly difficult for young consumers to obtain smoke in a safe and reasonable manner.

Against this backdrop, several groups of campaigners argue that the proposed tax reform is flawed.istine Vapeall argue that increasing taxes would make it harder to get Nicotine in TikTok and Nicotine Pouches, as these products are already costly. They argue that fines for selling to minors should be made more stringent, with demonstrators criticizing the proposed approach as uneven and unethical. S Bien, a spokesperson for the Independent European Vape Alliance, pointed out that the proposed tax system would not only protect young people but could also create new threats to their mental health. He argued that if companies continue to produce these products, the risks of>>)…) manual intervention will increase subtly everywhere.”, he explained. He emphasized that the tax system “should not be used to create threats of violence or harm.”

The limitations of this tax policy are increasingly evident. Countries with higher tax rates on tobacco and nicotine products face better access to these products, but so too many have lower taxes, leaving them at a disadvantage. In Germany, for example, the government has already issuedSummary of Proposal, a policy that limited the sale of Nicotine Pouches in 2023. In contrast, countries with higher vecils banning e-cigarettes or not.t후 direct taxes encourage the sale of Nicotine and tobacco products, but their broader implementation calls for a coordinated effort to ensure fair exploitation. While the EU has been proactive in its tax reform efforts, the lack of clarity among different countries, especially in the carrot and stick approach, remains a significant challenge. Simultaneously, the increasing workload for many tax reg lovers and the sharp rise in nicotine-related health risks call for a more practical and equitable solution.

Despite the growing pressure, progress on this issue is slow. While the EU is taking steps to revisit tax-related legislation, voices in other countries remain against any reform. For instance, in countries with lower taxes, such as Italy and Greece, the proposed changes to the tobacco tax system could hinder firm profitability. At the same time, other groups, such as the Nicotine Free Group in Germany, argue that the tax system simply doesn’t have the power to protect young people. They highlight that even the smallest tax increments could make a difference in the lives of many citizens, raising concerns about fairness and justice.

In conclusion, the international community faces a daunting challenge to this evolving tax system. Whether it’s creating a more equitable and just tobacco tax policy or safeguarding vulnerable populations, the issue requires a complex and multi-party effort. As the EU continues to navigate these challenges, ensuring that the new tax system benefits not only the wealthy but also young people, remains a must for a responsible political action.